A lot of strange things happened in the financial markets late on Friday afternoon and a good deal of the craziness was in the VIX futures market, with impacts felt in the likes of VXX, which jumped 11.6% in less than an hour (the last 40 minutes of the regular session and the first 14 minutes of after-hours trading.)

The corresponding spike in the VIX futures prices pushed the front two months of the VIX futures term structure into backwardation (a downward sloping term structure curve in which front month futures contract is priced higher than the second month futures contract) for only the second day since November 2011, with the lone exception dating from May 18, 2012, when the front two month contracts were in backwardation by a mere 0.05 points.

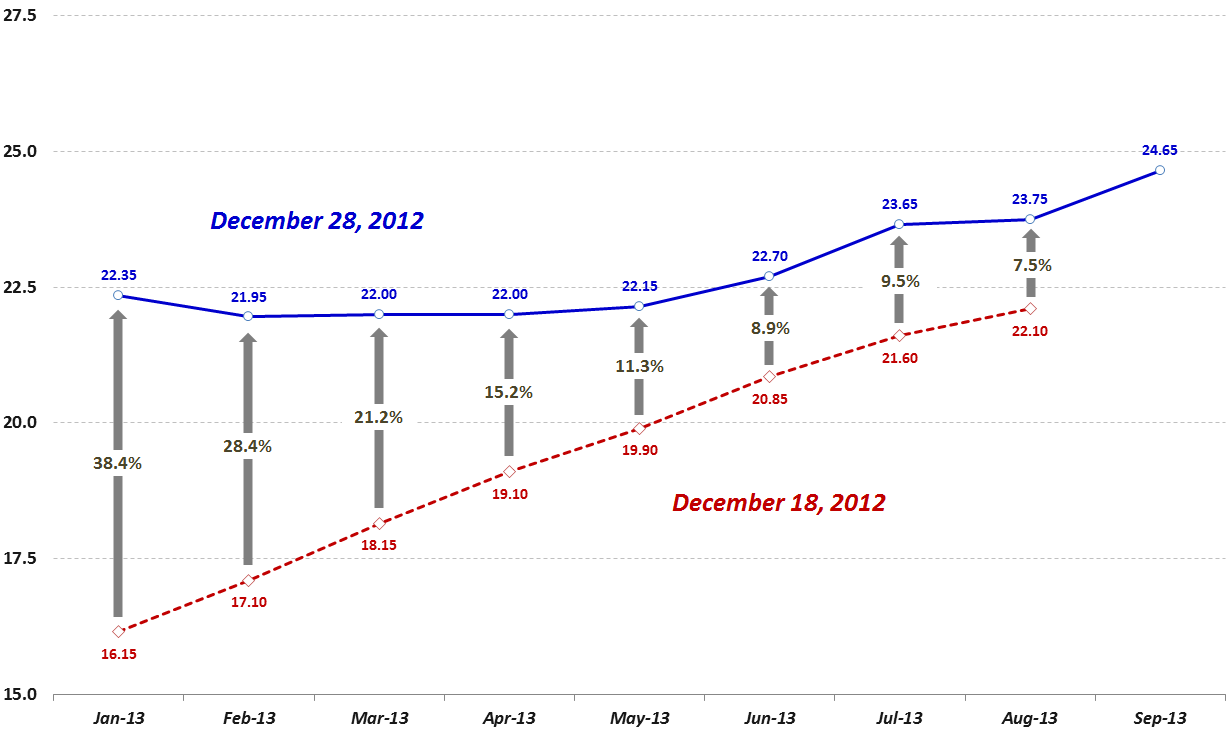

The chart below shows how the VIX futures term structure changed over a ten-day period from December 18 to December 28. While all eight VIX futures contracts that were trading on both dates showed in increase, the magnitude of these increases were skewed dramatically toward the front months, where the January VIX futures contract jumped 38.4%, the February contract gained 28.4%, the March contract rose 21.2%, etc. Also of note, whereas the December 18th term structure was upward sloping in an almost perfect linear fashion, by December 28th the term structure had twisted so that the January contract is now trading at a higher level than the contracts for the February, March, April and May expirations. In fact, the market is now pricing in expectations that a VIX of about 22 will persist for the next five months.

[source(s): CBOE Futures Exchange (CFE)]

With the backwardation in the front two months of the VIX futures contracts, this also means that investors who are looking to hedge long equity exposure against an increase in volatility can now take advantage of what is essentially free portfolio insurance. Of course I am using the ?free? label loosely, but given that the short-term VIX futures (first and second month contracts) are in contango (front months less expensive than more distant months) more than 80% of the time and subject to the price decay associated with negative roll yield while in contango, I feel it is important to underscore that the short-term VIX futures roll yield is now positive, meaning that if the VIX January and February contracts do not change in price, the positive roll yield should provide a small lift to VXX, UVXY, TVIX and the other short-term VIX ETPs with a long volatility bias.

Now before anyone gets too excited about the possibility of free portfolio insurance, it is important to understand that the reason the VIX futures are in backwardation is that market participants anticipate that the VIX will decline going forward, making a long volatility hedge of limited value. So while long positions in VXX, UVXY, TVIX and their ilk are benefiting from positive roll yield at the moment, most investors consider that a decline in the VIX and VIX futures is likely to more than compensate for any gains due to roll yield, meaning that these hedges will probably be net losers when one accounts for the changes in the VIX futures and the roll yield.

[Since some of the subjects above have not come up for discussion in a fairly long time, today?s set of links is more comprehensive than usual. As always, these are not arranged in order of significance, but are grouped roughly by subject matter, with some of the more recent posts on the subject toward the top.]

Related posts:

Disclosure(s): short VXX and UVXY at time of writing

Source: http://vixandmore.blogspot.com/2012/12/portfolio-insurance-for-almost-free.html

walking dead finale nascar bristol narwhal st louis university mario manningham mario manningham williams syndrome

No comments:

Post a Comment